The state of the technology landscape for digital commerce in 2023: how innovative vendors can capitalise on the opportunity

The whirlwind of change sweeping through the digital commerce technology landscape is visible for all to see, driven by the unrelenting force of consumerisation.

But to understand its deeper impact, it takes knowledge and experience of operating in the market to understand the changing technology terrain, connect the dots and identify opportunities.

Some moments are reflected through incremental evolutions in advancement, like new models of smartphones or a point release on a commerce platform. Other periods are marked by revolutionary change, where years of progress is made in months, as we all experienced through the pandemic impact on retail and hospitality through 2020/21.

Arguably, today the expectation arising around AI chatbots and writing tools certainly hypes the expectation of major change that is set to impact life as we know it.

Our team of commerce and integration experts, through Tryzens and Fuse, live and breathe digital commerce, serving brands and tech innovators to create compelling customer experiences that drive growth. They have come together to help you make sense of the changing landscape for digital commerce and bring you clearer insight into merchant priorities.

Let’s unpack some of the major trends that are emerging in 2023 and what it all means for innovative technology companies seeking to serve the commerce market.

The macrotrends that are front of mind for merchants this year are largely grouped in to the following four buckets:

1. Post-pandemic reality is shaping decision-making

The heydays of a forced market on digital platforms from pandemic-related store closures are over. While digital remains very much stronger and more valuable than in the pre-pandemic days, merchants are looking at how they support their customers across their broader omnichannel strategy and leverage the power of digital commerce efficiently no matter how a customer engages with them.

2. External factors are making economic prudence a priority

Global and national issues such as war, energy security, supply chain disruption, inflation and Brexit have compounded the economic impact on businesses and households. Consumers are spending less; merchants are sweating their assets, as they look to cut costs while optimising what they already have.

Cashflow is critical, so decisions are being more thoroughly analysed to determine the likelihood of realising a credible return on investment to justify budgeted spend as well as unbudgeted spend. The business case benefits have never been more important in terms of reducing the time it takes to demonstrate a sustainable return.

3. Knowing and growing your customers has never been more important

Access to customer behaviour and first-party data has been restricted through the containment of cookies and privacy laws, most notably the California Consumer Privacy Act (CCPA) that covers the state of California and the General Data Protection Regulation (GDPR) that covers the European Union.

This means that it’s never been more important to know your customers, understand their needs, and evolve strategies that harness loyalty. Frequency of engagement, average order value, and lifetime value have become core metrics. Equally important for merchants is improving their omnichannel experiences to acquire new customers and nurture them into loyal customers. This is due to current doubts over the efficacy and return of ad spend.

4. Best of breed is back in fashion

In looking to make incremental changes, merchants are looking to tools and solutions that give them a tactical advantage. This has been bolstered by the rate of innovation seen over the pandemic years but also by the growth in awareness and appeal of headless and composable architectures. These play down the value of an enterprise monolith solution that does everything and favour harnessing best-of-breed products within a wider architecturally efficient strategy for being API enabled and microservices based.

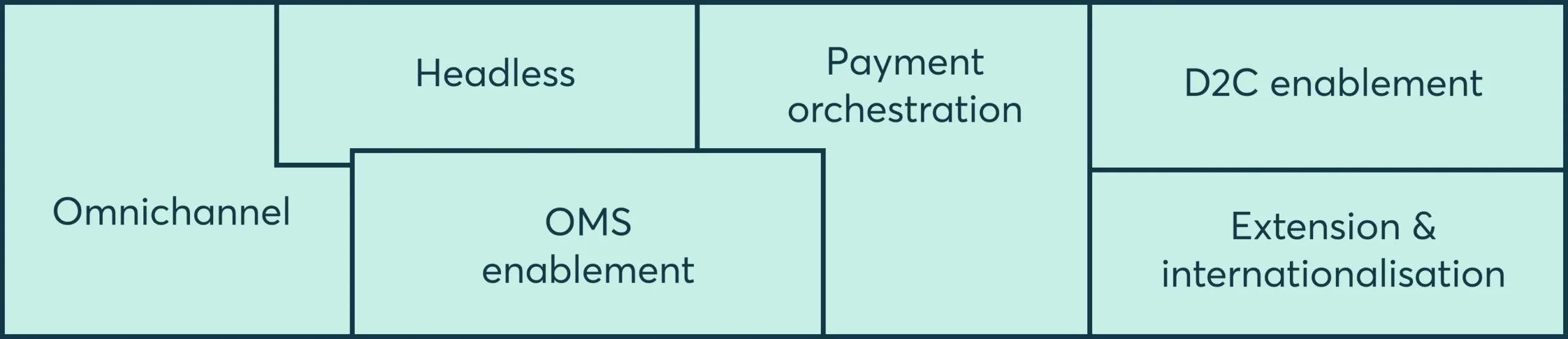

These trends have shifted merchants’ attention towards specific areas to help drive revenue growth. These include:

Omnichannel for customer acquisition and loyalty

Working within a constrained economic landscape, merchants are working on ways to expand its customer base, making the pathway to purchase more efficient, and build customer loyalty.

To provide consistency across all touchpoints, businesses need to provide seamless omnichannel experiences. And to do that, they need a centralised, singular view of their customers.

The level of complexity involved in delivering omnichannel experiences varies. The size of the business, the number of managed channels, and the maturity of the technology stack are all ingredients that are baked into a merchant’s capabilities.

Nonetheless, it requires the integration of customer data across multiple platforms, such as CRMs and CDPs, to have a single source of truth. This is the basis from which merchants can carry out deep AI analysis, looking at how customers interact with them across channels and devices. This feedback is then fed into building personalised experiences, customer loyalty programmes and customer acquisition strategies.

A key takeaway for tech vendors is that that merchants are making more considered choices with their solutions. With restrained budgets, returns on investment are being driven by evidenced-based, risk-assessed solutions. Tech vendors that can speak directly to the real problems that merchants are facing hold the keys.

Headless with a mobile-first approach

One characteristic that is crucial for merchants this year is agility. The ability to adapt in times of uncertainty and thrive. For organisations that don’t have the budget or time to carry out big platform implementations, they’re looking around the market for alternative technologies to help unlock growth.

One of these is headless technology, which gives businesses greater ability for customisations and faster time-to-market. Because a headless framework separates the backend from the frontend, it’s easier to change and reuse content across channels without affecting underlying architecture.

A headless approach also helps to improve SEO performance, including page speed loading times. The speed of a page has a huge impact on where it ranks, particularly on mobile – a key touchpoint for product browsing and purchasing. If merchants didn’t have a mobile-first digital commerce strategy, they’re now working on one to optimise their digital experiences on mobile – both on browsers as well as apps.

OMS enablement with a single view of stock

Merchants are approaching issues with supply chains in a number of ways. One of the more effective approaches is to develop a single view of stock, using accurate and real-time data to better manage orders and fulfilment.

Having too much stock tied up in warehouses is a big drain on costs. With low stock, merchants run the risk of draining customer satisfaction if orders can’t be completed. With the right data fed into an order management system (OMS), businesses can identify where their customers are buying from, which products are selling and which are not, and which times of year specific products are purchased.

With one view of inventory, merchants can better balance levels of stock and provide consumers with the broadest product offering possible across all channels. It’s only about the path to purchase. Merchants are also using data from their OMS platforms to improve the post-purchase experience as another avenue to build brand loyalty.

Payment orchestration

One area that has big market potential is payment orchestration. Many businesses have already integrated multiple payment services, providing customers with list of payment methods.

The problem is that displaying a long list of payment providers can be confusing or irritating to customers – particularly loyal customers who have a preferred payment method that they have to scroll through to find. And what happens when one payment method is available in one country but not another?

Payment orchestration is all about optimising the flow of payments. With a payment orchestration platform, merchants can integrate multiple payment methods, making it easier to manage and personalise the checkout process to improve the customer experience. This enables the right payment methods to be shown to the right customer in the right order tailored to the specific compliance and tax regulations of where the customer is.

Growth through extension and internationalisation

Two types of growth that we are seeing among merchants is range extension and international expansion. For merchants that don’t currently have the bandwidth to expand their own range of products, they can partner with affiliates to showcase and sell related products – without the hassle of having to manufacture or stock the products.

For example, a clothing brand can complement its line of branded running apparel with other brand accessories they think their customers will want, such as water bottles or headwear. Range extension can be thought of as a strategy to create a marketplace specific to a merchant.

This extends the merchant’s product range without having to go through the process of producing the products and managing their stock levels – along with the associated costs involved.

For merchants that have followed the pattern of interest in their products and services to untapped markets, this is a time for international expansion. This requires the right tech stack to be able to deal with local currencies, languages, taxes and regulations. Third-party vendors are able to facilitate a brand’s gradual expansion into new markets, helping them establish a digital presence first to test the waters being scaling up if necessary to have boots on the ground and physical stores opened.

D2C enablement

We are seeing more and more merchants establish a direct-to-consumer approach. Interestingly, it’s not necessarily to compete with their retail channels but to deepen their understanding of their own customers to improve their products and customer service.

By removing intermediaries, businesses are better positioned to engage with their customers in multiple ways. For example, merchants can collect customer data like buying habits, preferences and demographics. This can then be analysed to gain insight into behaviour to improve their products.

They can also develop more direct communication channels with customers, using multiple channels like social media and email as well as live agents and chatbots across websites and apps. All of this feeds into strategies to increase repeat purchases, average order values and lifetime value. Ultimately, to build brand loyalty.

How can innovative vendors capitalise in the current digital commerce landscape?

The state of the technology landscape for digital commerce is creating major opportunities for third-party technology vendors and independent software vendors (ISVs). Let’s take a look.

The economic climate has created a need for businesses to quickly adapt and optimise their technology solutions. The pandemic accelerated this movement as businesses rushed to develop a digital-first, ecommerce approach. Post-pandemic, digital commerce growth is decelerating. And the global economy continues to suffer from stubbornly high inflation rates.

This has forced businesses to revisit their tech stacks – much of which was quickly assembled during the hazy days of rapid digital adoption. This has led many businesses to confront its accumulated technical debt, cleaning up its code, rebuilding its systems and optimising their processes.

This presents opportunities for third-party vendors and ISVs to come in and help reduce businesses dealing with technical debt. For example, vendors can offer pre-packaged components and cartridges that integrate into existing systems – reducing the amount of code needed. They can also deepen partnerships by offering ongoing support and maintenance, carrying out code reviews and audits to eliminate technical debt and optimise tech stacks.

More broadly, the current technology terrain seems purpose-built for third-party vendors to thrive. Businesses of all sizes are increasingly integrating solutions to help meet their evolving needs. On average, large organisations are now using 976 applications compared to 843 in 2021, according to a MuleSoft study. However, just 28% of these applications are integrated. This is where third-party vendors can step in, providing customers seamless integrations of technology solutions.

With pre-built integrations and cartridges, third-party vendors can also help their customers accelerate the time-to-market, enabling them to quickly adapt to shifting consumer behaviour and maintain competitive edge in the fast-moving tech landscape. And because they’re pre-built, it helps businesses reduce development costs.

What ties all these areas together is that they complement each other. Omnichannel, headless, OMS, payment orchestration, and going D2C are all strategies that help to better understand customers, which helps to deliver the right experiences to drive loyalty and ultimately revenue. To carry this out effectively, it requires a comprehensive commerce integration strategy.

Fuse removes the hassle of integrations, helping technology vendors connect seamlessly with the commerce landscape, no matter what the platform or technology. If you’re looking to optimise your commerce integration strategy to meet the current needs of merchants, contact us!